change in net working capital dcf

So 1421666B 928M 13288B. The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC.

How Changes To The Corporate Tax Code Could Impact Business Valuations Stout

Answer 1 of 6.

. Add back the depreciation and amortization charges. The implications of this assumption in a long-term forecast must be carefully analyzed. Most businesses have lumpy working capital needs that.

Although they are considered expenses from an accounting perspective thus deducted in the. Look closely at the image of the model below and you will see a line labeled Less Changes in Working Capital this is where the impact of increasesdecreases in accounts receivable inventory and accounts payable impact the unlevered free cash flow of a firm. The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC.

Changes in net working capital impact cash flow in financial modeling. In this article we will learn working capital projections using assumptions. You have to think and link what happens to cash flow when an asset or liability increases.

One is to use the change in non-cash working capital from the year 307 million and to grow that change at the same rate as earnings are expected to grow in the future. The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. Stable WC Change WCEBITDA EBITDA t terminal growth 1terminal growth.

However if the change in NWC is negative the business model of the company might require spending cash before it can sell. The change refers to how the cash flow has changed based on the working capital changes. Deduct the debt of last year to find the net asset value.

A negative change in working capital working capital forecast to decrease is also possible in certain businesses and at certain times such as when a business is experiencing a downturn in its markets. NSIT Change In Working Capital as of today April 17 2022 is -163 Mil. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period Change in Net Working Capital 12000 7000 Change in Net Working Capital 5000 Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities.

Using operating cash flow numbers straight from a companys filings can cause huge swings in DCF models because of changes in working capital. In our last tutorial we have understood detailed calculations of FCFF. If the change in NWC is positive the company collects and holds onto cash earlier.

Here is an example of the calculations. Working capital changes can make cash flows lumpy and simply putting last years or the trailing twelve month free cash flow number into a DCF model could produce wild swings. It is the CF after funding cash required to fund growth or cash relieved by managing asset efficiently.

Step 3 Changes in Non-Cash Net Working Capital. FCF is the free CF. The Change in Working Capital gives you an idea of how much a companys cash flow will differ from its Net Income ie after-tax profits and companies with more power to collect cash quickly from customers and delay payments to suppliers tend to have more positive Change in Working Capital figures.

Is typically the most complicated step in deriving the FCF Formula. In this video I cover the different ratios tha. What does an increase in working capital mean.

Change in Working Capital is a cash flow item and it is always better and easier to use the numbers from the cash flow statement as I showed above in the screenshot. Converting Accounting Earnings into Cashflows. Merely because a company produces a net profit of 100000 does not mean the company has 100000 in cash available to.

The entire intuition behind CA-CL is to arrive at how cash has changed over the period increases in CA use of cash increase in CL source of cash--in that sense you would use non-cash CA - CL to get to FCF to do your DCF. Discounted cash flow. Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any shortage of funds or the funds should not lie idle in future.

Calculating the changes in non-cash net working capital Net Working Capital Net Working Capital NWC is the difference between a companys current assets net of cash and current liabilities net of debt on its balance sheet. The changes in working capital are discounted using the WCSales ratio working capital over sales which in this case is 80 8510 094. The second file includes other working capital items and has a bit more detail In evaluating stable working capital both files demonstrate that you can use the following formula in the terminal period for stable working capital.

The Working capital is the difference between a companys current assets and current liabilities. Part II of this blog identifies methods often used by business appraisers when forecasting working capital. You seem to have asked two questions 1 Why NWC is deducted and 2 Should cash be part of NWC.

How do you project changes in net working capital NWC when building your DCF and calculating free cash flow. Image by Sabrina Jiang Investopedia 2020 Imagine if Exxon borrowed an additional 20 billion in. In DCF we are calculating FCF either FCFF or FCFE.

There would be no change in working capital but operating cash flow would decrease by 3 billion. In depth view into Insight Enterprises Change In Working Capital explanation calculation historical data and more. At the core working capital changes are analyzed and projected to ensure changes in cash are correctly forecast.

If youre asking whether you include cash in the CA to get to change in net working capital the answer is no.

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

How Changes To The Corporate Tax Code Could Impact Business Valuations Stout

Net Operating Losses Deferred Tax Assets Tutorial

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Discounted Cash Flow Model Dfc Formula And Example

Net Operating Losses Deferred Tax Assets Tutorial

How Changes To The Corporate Tax Code Could Impact Business Valuations Stout

Discounted Cash Flow Model Street Of Walls

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Calculate Value In Use Under Ias 36 Magnimetrics

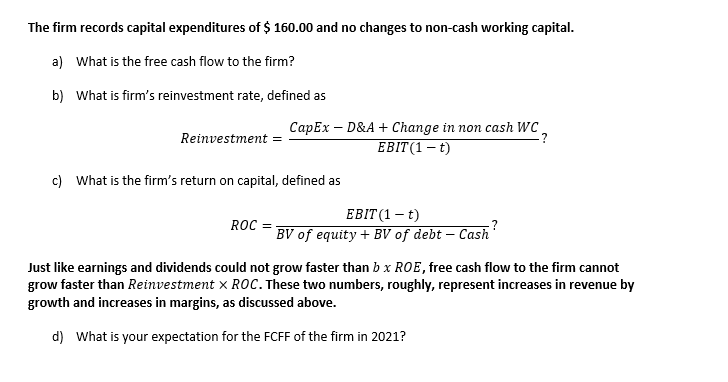

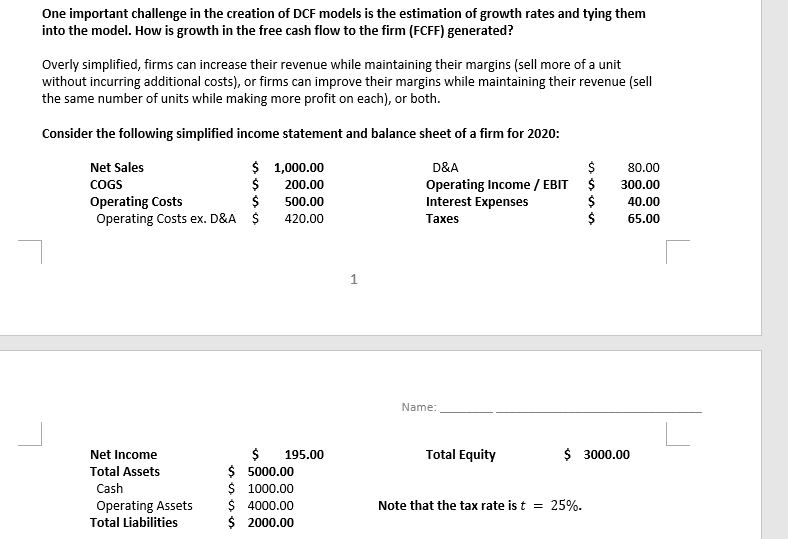

Solved One Important Challenge In The Creation Of Dcf Models Chegg Com

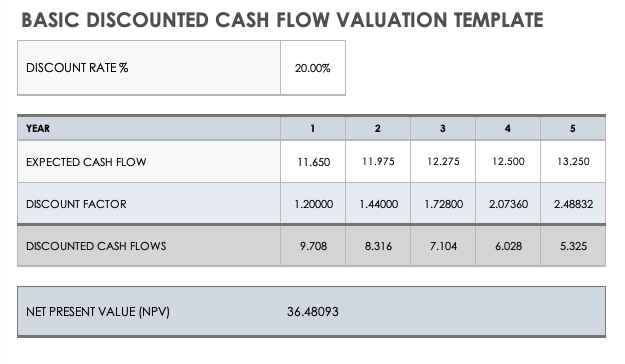

Free Discounted Cash Flow Templates Smartsheet

Calculate Value In Use Under Ias 36 Magnimetrics

Free Discounted Cash Flow Templates Smartsheet

Unlevered Free Cash Flow Definition Examples Formula

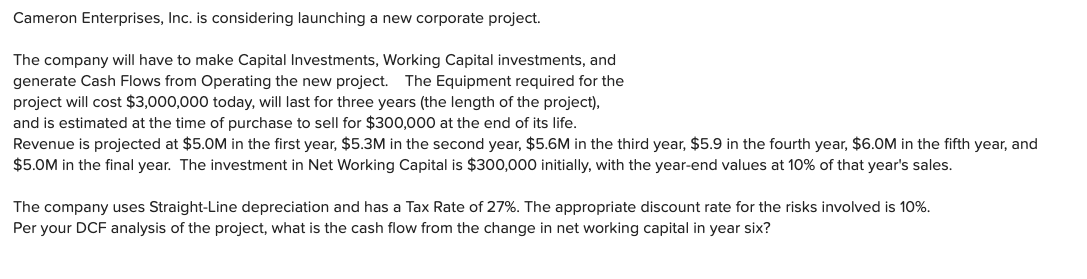

Solved Cameron Enterprises Inc Is Considering Launching A Chegg Com

Free Discounted Cash Flow Templates Smartsheet

Solved One Important Challenge In The Creation Of Dcf Models Chegg Com